Investment: retail is the second least affected sector after hotels with €26.2bn invested in 2023

Investment in European retail fell 40% in 2023 vs 2022, to € 26.2bn. Yet investor interest in retail assets is slowly gaining more traction in terms of investment market share (20% in Q4 23 vs 16% in Q4 22).

“This level has not been seen for five years (20% in 2018). As a result, retail was the second least affected sector after hotels”, says Patrick Delcol, Head of European Retail at BNP Paribas Real Estate.

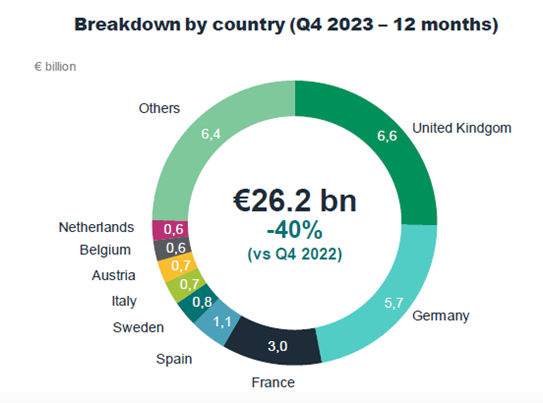

Retail Investment by country: UK, Germany and France accounted for 60% of the activity

Investment in retail warehouses in the largest European countries* came to € 8.5bn over 2023. This segment, although down 28% vs 2022, showed the greatest resilience among the retail subsegments. It accounted for 50% of overall investment in retail assets and is proving increasingly attractive to investors.

The high street segment has seen the biggest year-on-year decline (-50%) with investment of € 4.9bn. However, this fall should be seen in the light of the exceptional 2022 figure (€ 9.7bn). We note that this number does not include the € 2.9bn of owner-occupier deals transacted by luxury brands on the most prestigious Paris avenues.

Lastly, the shopping centre segment recorded a fall of 55% vs. 2022, with investment of € 4bn.

Attractive risk premium for retail warehousing and shopping centres

The rapid rise in risk-free rates in 2022 and 2023 has driven up prime yields, leading to repricing across all asset categories.

Retail prime yields started to expand in the second half of 2022 and continued to do so throughout 2023. This yield expansion remains less pronounced than for other asset categories (office or logistics), as they had already adjusted at the time of the health crisis in 2020.

“Prime yields for retail warehousing and shopping centres remain very appealing throughout Europe and continue to attract investor interest. They are the segments that offer the best risk premiums of all real estate asset categories”, remarked Patrick Delcol.

Download the press release for more insights

Find out about prime rents, new strategies and promising prospects in the retail market.