Logistics letting markets have generally held up well...

...despite weak economic growth which is expected to remain positive in 2024.

Indeed, GDP growth started to pick up in the Euro area at the beginning of the year from +0.5% in 2023 to +0.8 % forecast in 2024.

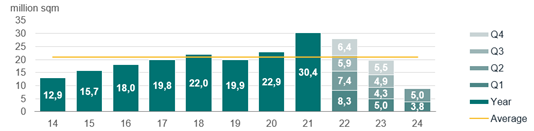

Occupier concerns about cost control in a still weak economy are slowing expansion. In H1 2024, the market decreased by 5% versus H1 2023. Demand has been lagging and most countries recorded a slow start to the year. Yet, market fundamentals remain healthy despite rising supply in some countries and there are signs of inventories increasing in the second half of 2025.

In Germany, after a cautious start to the year, the market picked up in Q2 2024, particularly outside the main logistics hubs. The weak economy continues to have a slowing effect on demand. The lack of available space remains a limiting factor in some markets, which in turn has been supporting rental growth.

In the UK, the market bottomed out in Q2 2023 and has been picking up since then. Take-up increased in H1 2024 supported by strong demand from the Food & Beverages industry and continued logistics demand in the Midlands in particular. Supply is stabilizing after ticking up for two years. There is still a lack of speculatively developed new units.

In France, market slowdown in H1 2024 has been unsurprising as the economy remained slow. Demand dropped significantly in Greater Paris, Marseille and Lyon with well below average levels of transactions. Lille and Orléans on the other hand concentrated nearly half of France’s transaction volume during the half of the year. Overall, land is becoming scarce, and the lack of supply has become recurrent in some markets. The vacancy rate in France reached 4.1% at mid-year.

The Netherlands, like most European countries, is recording a slow start in H1 2024. High land prices and development costs are inhibiting new developments. Low availability is still putting pressure upwards on rents.

In Spain, after a slow start to the year, the Spanish market bounced back in Q2 2024 maintaining a good volume of transactions, particularly in Madrid and Valencia. Vacancy rates eased just 5.4% in Barcelona and at 8% in Madrid, whilst supply remained tight in Valencia. Prime rents stabilized in Barcelona and Valencia but increased in Madrid during Q2 2024.

In Poland, the occupier market picked up in Q2 2024 after a slow start in Q1. The vacancy rate remained at around 8% and prime rents stabilized. A noticeable trend is the sharp decrease in the share of new construction projects launched on a speculative basis. However, the volume of take-up at 1,6 million sqm represented a 20% increase vs H1 2023 and places Poland at the 3rd position in Europe.

Download the press release for more insights

Find out more about the European logistics market.